Example of CVA computation¶

This example is taken from the following website: http://www.pricederivatives.com/en/derivatives-cva-example-monte-carlo-python/. We’ve taken advantage of some functionalities provided by pyql to simplify the computations.

Here we’ll show an example of code for CVA calculation (credit valuation adjustment) with Python and Quantlib using a simple Monte-Carlo method for a portfolio consisting solely of a single interest rate swap. It’s easy to generalize this code to include more financial instruments.

CVA calculation algorithm¶

Simulate yield curve at future dates.

Calculate your derivatives portfolio NPV (net present value) at each time point for each scenario.

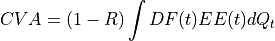

Calculate CVA as sum of Expected Exposure multiplied by probability of default at this interval

where

is the Recovery (normally set to 40%),

is the Recovery (normally set to 40%),  the expected exposure at time

the expected exposure at time  ,

,  the survival probability density, and

the survival probability density, and  discount factor at time

discount factor at time  .

.

Outline¶

In this simple example, we will use the Hull White model to generate future yield curves. In practice, many banks use some yield curve evolution models based on historical simulations. In the Hull White model, the short rate

is distributed normally with known mean and variance.

is distributed normally with known mean and variance.For each point of time we will generate whole yield curve based on short rate. Then we will price our interest rate swap on each of these curves.

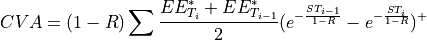

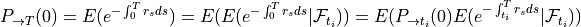

to approximate CVA we will use BASEL III formula for regulatory capital charge approximating default probability [or survival probability ] as exp(-ST/(1-R)) so we get:

where

is discounted Expected exposure of portfolio.

is discounted Expected exposure of portfolio.

Hull-White model for future yield curve simulations¶

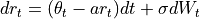

the model is given by dynamics:

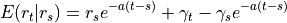

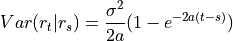

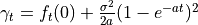

In the Hull White model, the short rate  is distributed normally with mean and variance given by

is distributed normally with mean and variance given by

where  and

and  is the instantaneous forward rate at time

is the instantaneous forward rate at time  as seen at time 0. The calculations will not depend on

as seen at time 0. The calculations will not depend on  . To generate the future values of

. To generate the future values of  , we use the simulate_process function which is a convenience function provided in the simulate module of pyql. After getting a matrix of all

, we use the simulate_process function which is a convenience function provided in the simulate module of pyql. After getting a matrix of all

for all draws and time points, we will construct a yield curve for each

for all draws and time points, we will construct a yield curve for each  using Hull White discount factors

using Hull White discount factors  at each future date.

at each future date.

for each future time point  ,

,  being the maturity.

being the maturity.

also we’ll output some generated yield curves.

[36]:

from quantlib.settings import Settings

from quantlib.time.api import (Date, Actual360, TARGET, NoFrequency, Period,

Years, Schedule, ModifiedFollowing, Following, Rule)

from quantlib.termstructures.yields.api import DiscountCurve

todaysDate = Date(26, 12, 2013);

Settings().evaluation_date = todaysDate;

crvTodaydates = [Date(26, 12, 2013),

Date(30, 6, 2014),

Date(30, 7, 2014),

Date(29, 8, 2014),

Date(30, 9, 2014),

Date(30, 10, 2014),

Date(28, 11, 2014),

Date(30, 12, 2014),

Date(30, 1, 2015),

Date(27, 2, 2015),

Date(30, 3, 2015),

Date(30, 4, 2015),

Date(29, 5, 2015),

Date(30, 6, 2015),

Date(30, 12, 2015),

Date(30, 12, 2016),

Date(29, 12, 2017),

Date(31, 12, 2018),

Date(30, 12, 2019),

Date(30, 12, 2020),

Date(30, 12, 2021),

Date(30, 12, 2022),

Date(29, 12, 2023),

Date(30, 12, 2024),

Date(30, 12, 2025),

Date(29, 12, 2028),

Date(30, 12, 2033),

Date(30, 12, 2038),

Date(30, 12, 2043),

Date(30, 12, 2048),

Date(30, 12, 2053),

Date(30, 12, 2058),

Date(31, 12, 2063)]

crvTodaydf=[1.0,

0.998022,

0.99771,

0.99739,

0.997017,

0.996671,

0.996337,

0.995921,

0.995522,

0.995157,

0.994706,

0.994248,

0.993805,

0.993285,

0.989614,

0.978541,

0.961973,

0.940868,

0.916831,

0.890805,

0.863413,

0.834987,

0.807111,

0.778332,

0.750525,

0.674707,

0.575192,

0.501258,

0.44131,

0.384733,

0.340425,

0.294694,

0.260792

]

crvToday = DiscountCurve(crvTodaydates, crvTodaydf, Actual360(), TARGET())

[37]:

import numpy as np

months = range(3, 12 * 5 + 1, 3)

sPeriods = ["{}M".format(month) for month in months]

print(sPeriods)

Dates = [todaysDate] + [todaysDate + Period(s) for s in sPeriods]

T = np.array([Actual360().year_fraction(todaysDate, d) for d in Dates])

['3M', '6M', '9M', '12M', '15M', '18M', '21M', '24M', '27M', '30M', '33M', '36M', '39M', '42M', '45M', '48M', '51M', '54M', '57M', '60M']

[38]:

from matplotlib import pyplot as plt

import matplotlib

matplotlib.rcParams['figure.figsize'] = (15.0, 7.0)

from quantlib.processes.api import HullWhiteProcess

from quantlib.sim.simulate import simulate_process

from quantlib.time_grid import TimeGrid

Nsim = 1000

#parameters calibrated with Quantlib to coterminal swaptions on 26/dec/2013

a = 0.376739

sigma = 0.0209835

hw = HullWhiteProcess(crvToday, a, sigma)

grid = TimeGrid.from_vector(T)

rmat = simulate_process(hw, Nsim, grid, 1, antithetic=False)

dT = np.diff(T)

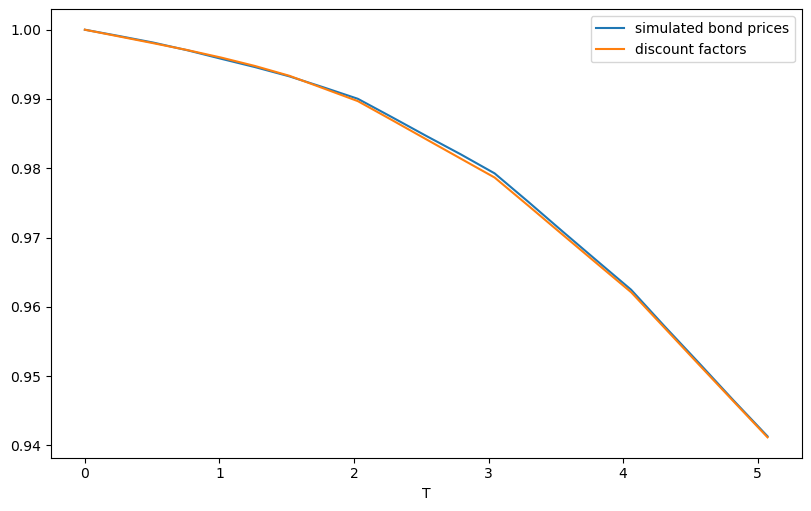

#check that bond prices match the original discount factors

bonds = np.empty_like(rmat)

bonds[1:] = np.exp(-(rmat[1:] * dT[:,None]).cumsum(axis=0))

bonds[0] = 1

bonds_mean = np.mean(bonds, axis=1)

fig, ax = plt.subplots(figsize=(8, 5), layout='constrained')

ax.plot(T, bonds_mean, label="simulated bond prices")

ax.plot(T, [crvToday.discount(t) for t in T], label="discount factors")

ax.set_xlabel("T")

ax.legend()

fig

[38]:

[39]:

from quantlib.models.shortrate.onefactormodels.hullwhite import HullWhite

start_date = Date(26, 12, 2013);

hw_model = HullWhite(crvToday, a, sigma)

crvMat = np.empty((len(T), Nsim), dtype='object')

crvMat[0] = crvToday

for i in range(1, len(T)):

crvDates = [Dates[i] + Period(k, Years) for k in range(21)]

crv_row = []

for n in range(Nsim):

rt = rmat[i, n]

crvDiscounts = [hw_model.discount_bound(T[i], T[i] + k, rt) for k in np.arange(21.)]

crvMat[i, n] = DiscountCurve(crvDates, crvDiscounts, Actual360(), TARGET())

bondT = np.zeros_like(rmat)

for n in range(Nsim):

for i in range(len(T)):

bondT[i,n] = bonds[i,n] * crvMat[i,n].discount(19 - T[i])

bondTmean = np.mean(bondT, axis=1)

np.set_printoptions(precision=4, suppress=True)

print('bondTmean-Terminal bond\n', bondTmean - crvToday.discount(19.))

bondTmean-Terminal bond

[0. 0.0056 0.0053 0.0048 0.0046 0.0056 0.0058 0.0065 0.0061 0.0057

0.0053 0.0056 0.0047 0.0048 0.004 0.0041 0.004 0.0036 0.0042 0.0034

0.004 ]

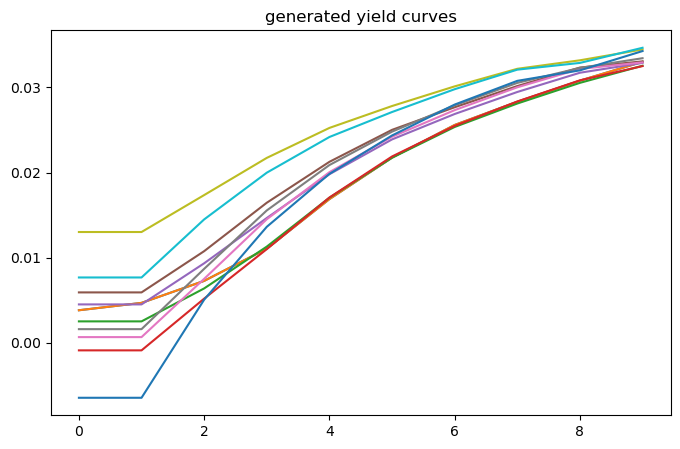

[47]:

from quantlib.compounding import Continuous

fig, ax = plt.subplots(figsize=(8, 5))

ax.plot(range(10),

[crvMat[0,0].forward_rate(t, t, compounding=Continuous, frequency=NoFrequency).rate

for t in np.arange(10.)])

for i in range(min(Nsim, 10)):

ax.plot(range(10), [crvMat[i,1].forward_rate(t, t,

compounding=Continuous, frequency=NoFrequency).rate

for t in np.arange(10.)])

ax.set_title('generated yield curves')

fig

[47]:

[41]:

from quantlib.indexes.api import Euribor6M

from quantlib.instruments.api import VanillaSwap, Receiver

from quantlib.pricingengines.swap import DiscountingSwapEngine

from quantlib.termstructures.yields.api import YieldTermStructure

#indexes definition

forecast_term_structure = YieldTermStructure()

index = Euribor6M(forecast_term_structure)

rmean = [hw.expectation(0., hw.x0, t) for t in T]

# we add a fixing every 6 months

for i in range(0, len(Dates), 2):

index.add_fixing(index.fixing_date(Dates[i]), rmean[i])

[42]:

#swap 1 definition

maturity = Date(26, 12, 2018)

fixed_schedule = Schedule.from_rule(start_date, maturity, Period("6M"), TARGET(),

ModifiedFollowing, ModifiedFollowing, Rule.Forward,

False)

floating_schedule = Schedule.from_rule(start_date, maturity, Period("6M"),

TARGET(), ModifiedFollowing,

ModifiedFollowing, Rule.Forward, False)

swap1 = VanillaSwap(Receiver, 10_000_000, fixed_schedule, 0.02, Actual360(),

floating_schedule, index, 0, Actual360()) #0.01215

[43]:

npvMat = np.empty((len(T), Nsim))

discount_term_structure = YieldTermStructure()

swapEngine = DiscountingSwapEngine(discount_term_structure)

npvMat = np.empty((len(T), Nsim))

swap1.set_pricing_engine(swapEngine)

for i, d in enumerate(Dates):

Settings().evaluation_date = d

for n in range(Nsim):

crv = crvMat[i, n]

discount_term_structure.link_to(crv)

forecast_term_structure.link_to(crv)

npvMat[i, n] = swap1.npv

[44]:

npv = npvMat[0,0]

#replace negative values with 0

npvMat[npvMat<0] = 0

EE = np.mean(npvMat, axis=1)

print('\nEE:\n', EE)

#print '\nrmat:\n',rmat

print('\nrmean:\n', rmean)

#print '\nrstd:\n',rstd

#print '\n95% are in \n',zip(rmean-2*rstd,rmean+2*rstd)

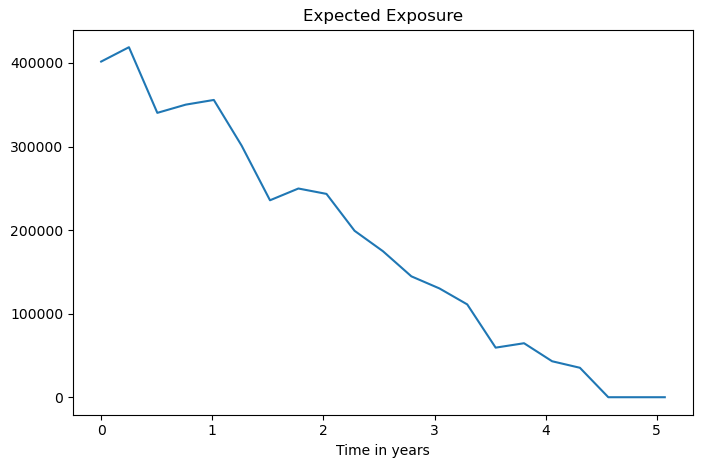

EE:

[401670.1158 418836.1352 340293.5483 350128.0023 355742.385 301135.2662

235679.9031 249760.1162 243312.1597 199152.445 174698.3439 144657.1733

130173.2957 111075.2397 59332.7639 64612.5595 43032.7119 35243.9918

0. 0. 0. ]

rmean:

[0.0038321783708768938, 0.0038447104458097666, 0.003878829192934586, 0.004304415296142585, 0.004854534792846587, 0.005486708976510404, 0.00618266474586651, 0.007652760916036794, 0.007726527486934385, 0.011583314187371059, 0.011655179426606066, 0.011724510502370677, 0.011790125103332274, 0.01767265729120667, 0.017732265414519513, 0.01778829449949869, 0.017840190647180572, 0.0227598814403213, 0.02280548353169784, 0.022847781363155784, 0.022886514765800076]

[45]:

# We use 5% for the credit spread and 40% for the recovery

from math import exp

S = 0.05

R = 0.4

r = 0

for i in range(len(T)-1):

r += 0.5 * crvToday.discount(T[i+1]) * (EE[i] + EE[i+1]) * (exp(-S*T[i]/(1.0-R)) -exp(-S*T[i+1]/(1.0-R)))

CVA = (1. - R) * r

print("\nnpv=", npv)

print("\nCVA=", CVA)

npv= 401670.1157927497

CVA= 40722.15743027281

[46]:

fig, ax = plt.subplots(figsize=(8, 5))

ax.plot(T, EE)

ax.set_xlabel("Time in years")

ax.set_title('Expected Exposure')

fig

#plot(T,np.mean(rmat,axis=0))

#plot(T,rmean)

#plot(T,[npvMat[0,0]]*len(T))

[46]: