quantlib.models.shortrate.onefactormodels.hullwhite.

HullWhite¶

- class HullWhite(HandleYieldTermStructure term_structure, Real a=0.1, Real sigma=0.01)¶

Bases:

VasicekSingle-factor Hull-White (extended Vasicek) model.

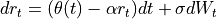

The standard single-factor Hull-White model is defined by

where

and

and  are constants.

are constants.Warning

When the term structure is relinked the

parameter

of the underlying Vasicek model is not updated.

parameter

of the underlying Vasicek model is not updated.- Attributes:

- Lambda

- a

- b

dynamicsshort-rate dynamics

- r0

- sigma

Methods

calibrate(self, list helpers, ...)convexity_bias(Real future_price, Time t, ...)Futures convexity bias

discount_bond(self, Time now, Time maturity, ...)discount_bond_option(self, ...)params(self)set_params(self, Array params)