BondForward¶

- class BondForward(Date value_date, Date maturity_date, Position position_type, Real strike, Natural settlement_days, DayCounter day_counter, Calendar calendar, BusinessDayConvention convention, Bond bond, HandleYieldTermStructure discount_curve, HandleYieldTermStructure income_discount_curve)¶

Bases:

ForwardForward contract on a bond

- value_date

refers to the settlement date of the bond forward contract.

- maturity_date

- this is the delivery (or repurchase date) for the underlying bond

(not the bond’s maturity date).

- Attributes:

clean_forward_price(dirty) forward bond price minus accrued on bond at delivery

error_estimateInstrument.error_estimate: Real

forward_price(dirty) forward bond price

forward_valueforward value/price of underlying, discounting income/dividends

is_expiredInstrument.is_expired: bool

net_present_valueInstrument net present value.

npvShortcut to the net_present_value property.

spot_valuespot value/price of an underlying financial instrument

valuation_datethe date the net present value refers to.

Methods

implied_yield(self, ...)implied yield

set_pricing_engine(self, PricingEngine engine)Sets the pricing engine.

spot_income(self, ...)NPV of income/dividends/storate-cossts etc.

Notes

Relevant formulas used in the calculations (

refers to a price): pomme

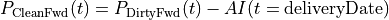

refers to a price): pommeClearn forward price:

where

refers to the accrued interest on the underlying bond.

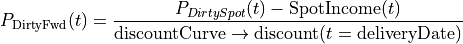

refers to the accrued interest on the underlying bond.Dirty forward price:

Spot income:

where

represents the ith bond cash flow (coupon payment)

associated with the underlying bond falling between the

settlementDate and the deliveryDate.

represents the ith bond cash flow (coupon payment)

associated with the underlying bond falling between the

settlementDate and the deliveryDate.

(Note the two different discount curves used in 1. and 2.)